First off, a huge thank you to everyone who’s voted on our onchain proposal so far. We genuinely appreciate everyone’s participation and the thought that’s gone into it.

A few themes have come up again and again in the discussions. We’ve pulled them together here in one place so we can give clear answers and make it easy for anyone else to access them.

1. Wallet and Custody

A recurring concern has been how wallets are provisioned, how private keys are secured, and whether we offer recovery methods, private key exports etc. This are all important points, and we’ve delved into greater details below.

Each user on LISAR gets an embedded smart wallet provisioned and managed by Privy, a provider already securing over 75M+ accounts for teams like Pump.fun, Farcaster, and OpenSea. Privy handles the heavy lifting of key management and secure storage, while still allowing users to export their private keys if they want full control. This way, users get both secure key management with industry-standard encryption and the option of self-custody if they prefer.

Wallets remain user-owned and securely provisioned, protected by industry-standard encryption and a key export option offering the flexibility to shift to full self-custody whenever users choose. This approach eliminates custody risk while ensuring the highest level of security and accessibility for everyone using LISAR

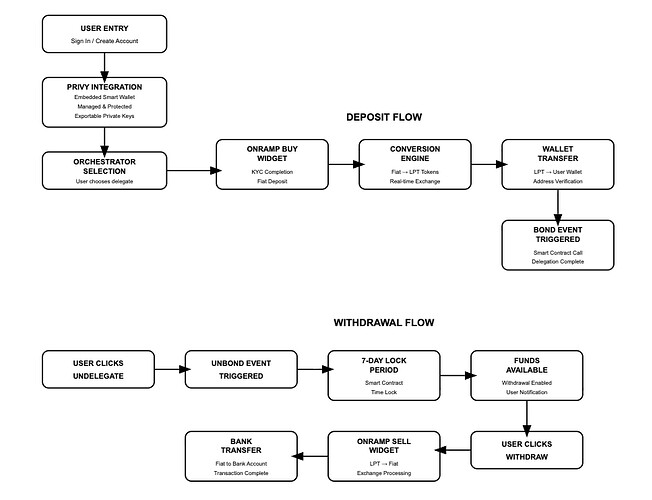

below is a diagram of the chain of process covering user onboarding, delegating and undelegating.

2. Volatility, Yield Projections & User Education

Another frequent concern is the need for proper education around the nature of crypto products, the possibilities of different APY outcomes, reward dynamics, and the impact of LPT price action. We completely agree, education is at the very core of LISAR

We’ve spoken often about delegator workshops. These workshops will educate users on token economics, crypto volatility, orchestrators, and staking mechanics so users fully understand what they’re participating in and expectations are set clearly from day one.

In addition to workshops, LISAR will also include a mandatory in-app onboarding curriculum, modeled after what has already worked successfully with Ugly.cash (a similar yield platform). This curriculum will cover:

- How LPT works and why it can be volatile

- How staking rewards and orchestrators function

- The basics of crypto economics and risks

- The withdrawal process and unbonding timelines

Completion of this curriculum will be a prerequisite before users can access any yield products on LISAR. This dual approach, delegator workshops plus in-app education ensures that everyone has both the context and the practical guidance to engage safely and confidently.

Also Looking Ahead - Yield Diversification

While we’re beginning with LPT delegation, a possible outcome is for LISAR is to expand into a broader suite of yield products over time. This will create a tiered reward system, giving users more options in how they participate:

- Stable, lower-yield options – such as USDC staking and lending protocols (principal remains stable with predictable but lower APY returns)

- Higher, variable-yield options – like LPT delegation (higher APY potential but with increased volatility and risk)

This structure gives users the flexibility to start where they’re most comfortable and gradually explore higher-yield opportunities as their knowledge and confidence grow.

3. Potential Liability Concerns for Livepeer

Another thoughtful concern recently raised is whether LISAR could create liability or reputational risk for the Livepeer protocol. This is an important point and we’ve taken this seriously and introduced safeguards to make sure LISAR does not create such risks for Livepeer.

Clear Independence

We will make sure all communication emphasizes that LISAR is not the official staking platform for Livepeer and that we operates as a completely independent service. Lisar only functions as a third-party staking provider—similar to platforms like Tenderize, Lido, Rocketpool etc. This clear independence ensures that any activity on LISAR cannot be misinterpreted, preventing potential reputational or liability concerns.

Orchestrator Opt-In

As an additional safeguard, orchestrator listings on LISAR will be on an opt-in basis. In other words, orchestrators will not be automatically listed on the platform—only those who opt to participate. By making participation voluntary, we remove any assumption of protocol-level involvement and make it clear that LISAR is a separate entity insulating the network from potential liability or reputational risk while still creating value by expanding access to delegation in new markets.

4. Legal and Regulatory

Finally we acknowledge the importance of regulatory compliance and have already taken proactive steps to ensure LISAR remains fully compliant in every market where we operate. Much of this has been discussed before

(see former posts), but it’s worth clarifying again here.

Regulatory requirements vary significantly from one region to another. Many of the concerns raised come from the stricter landscapes in the EU, UK, and U.S. However, Africa offers a far more enabling environment for financial products. It’s home to some of the world’s fastest-growing fintech ecosystems—with Lagos (Nigeria) alone hosting over 1,000 fintech companies—thanks to regulatory frameworks that encourage innovation rather than restrict it.

We also have strong market validation: services similar to LISAR are already live in the region and have processed over $6.15M in total volume within just a few months of launching. This demonstrates both demand and regulatory feasibility for crypto yield products in our target markets.

In short, there are no regulatory concerns for LISAR within Africa. We operate in a jurisdiction where similar products are already thriving, and we’ve aligned ourselves with trusted, licensed partners to ensure we remain fully compliant as we grow.

Final Note

Once again, thank you to everyone who has supported this initiative and to those who voiced concerns. This post is a direct response to the feedback we’ve received. We’ve taken it all seriously, realigned in some areas, and provided additional context in others to make sure the community is fully confident in what we’re building.

With these concerns now addressed, we’re hopeful for greater community support. Our onchain proposal is live, and we’d love for you to take part in shaping the outcome: Vote on proposal here.

Your feedback is what has gotten us this far, and with your continued support, we can take LISAR even further, building together toward a stronger and more inclusive Livepeer ecosystem!